Your financial solutions,

in one place.

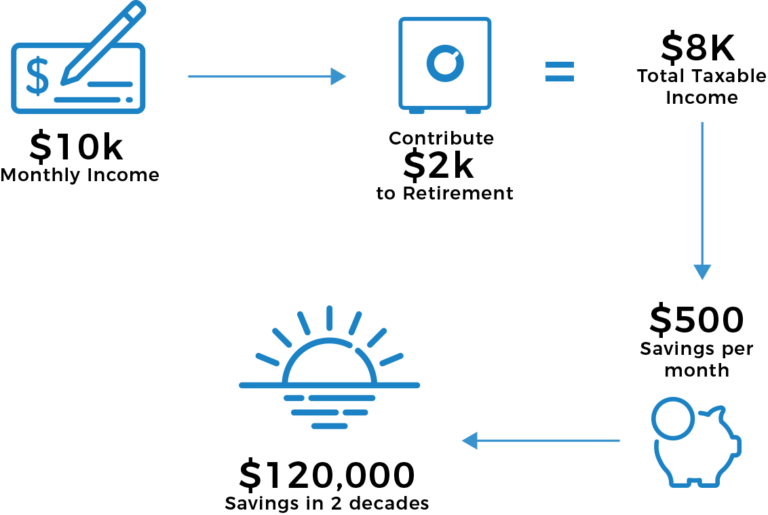

We specialize in implementing unique and effective techniques for lowering your tax obligations, including advanced planning and 401k designs (demonstrated to the right).

We can collaborate with your tax advisor to develop informed and appropriate year-end planning. This process allows us to determine a need to either realize gains or harvest losses in your investment portfolio, select the most efficient deferral strategy, and establish a gifting plan or charitable bequest. Profectus Wealth can bring to the table many tax-saving strategic resources to determine a course of action that best suits your financial situation and objectives.

Retirement Planning

Most of us spend our whole lives working hard at a career in order to give ourselves the best chance at enjoying a worry-free retirement. With the right resources and consistent support from experienced advisers, you can start planning today to effectively minimize or possibly eliminate your concerns about the future. Here’s just a few of the things we consider when building your unique retirement plan:

Wealth Management

Our lead advisers are involved in all aspects of selecting investment options, institutional managers, asset allocation, and tactical planning to support your financial goals. We believe that a formal process combining these important considerations is critical to your success.

Allocation & Diversification

The foundation of our investment strategy is a calculated combination of asset allocation and diversification. We believe that the selection of an appropriate mix of insurance-based products with traditional and alternative investment options is the key to a successful portfolio. Our systematic approach allows us to help our clients meet their investment objectives while lowering risks from overly investing in one asset class.

Tactical Planning

Using a tactical overlay by infusing certain non-correlated investment options allows us to potentially reduce overall risks. Our Investment Committee meets frequently to discuss our position on the global economy and financial markets, and to ensure that we have the appropriate processes and procedures in place to bring the vetted investment options suitable for our accredited investors.

Manager Selection

An important component of a strong investment portfolio is the manager selection. We attempt to select managers that consistently outperform their market benchmarks and peers. Considering the fact that there is no hard evidence proving one management style to be better than the other, our portfolios encompass a combination of both active and passive management.